Financial Fitness and RRSPs: Two roads to retirement

Are you a Charlie or a Sally?

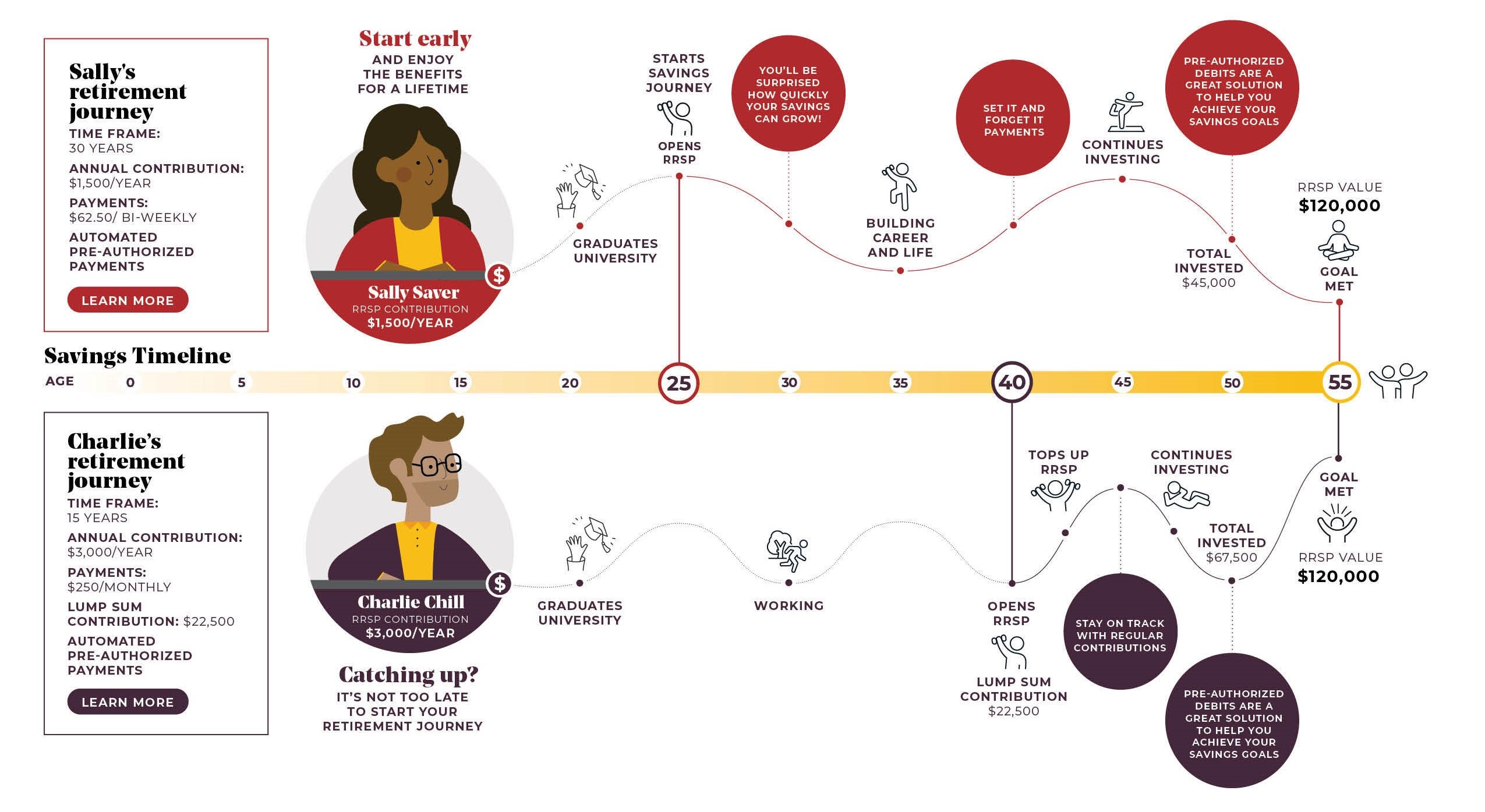

Like many members, Sally Saver and Charlie Chill are on a retirement journey, but each will reach their goal in a different way as they follow their own path along the road to retirement. It's never too early or too late to start saving for retirement. Some, like Sally like to start saving early, contributing a small amount regularly that over time will build up. Others, like Charlie, instead focused on growing his business, and though he has assets and investments, he hasn't yet turned his attention to saving for retirement specifically.Are you a Charlie or A Sally? Maybe somewhere in between. Read more about Sally and Charlie's retirement journeys.

Learn more about our savers

Sally Saver |

Charlie Chill |

| Age: 38 Education: University degree Employment: Teacher, full-time Homeowner: Yes, first home Lifestyle: fitness classes, outdoor activity (hiking, canoeing/kayaking), Pilates/yoga, volunteering Networth: Medium Debt: Medium |

Age: 40 Education: University degree Employment: Self-employed | Business Owner Homeowner: Yes Lifestyle: Running, skiing, inline skating,snowboarding, hiking backpacking, live sports, arts Net-worth: High (Higher income and assets) Debt: High |

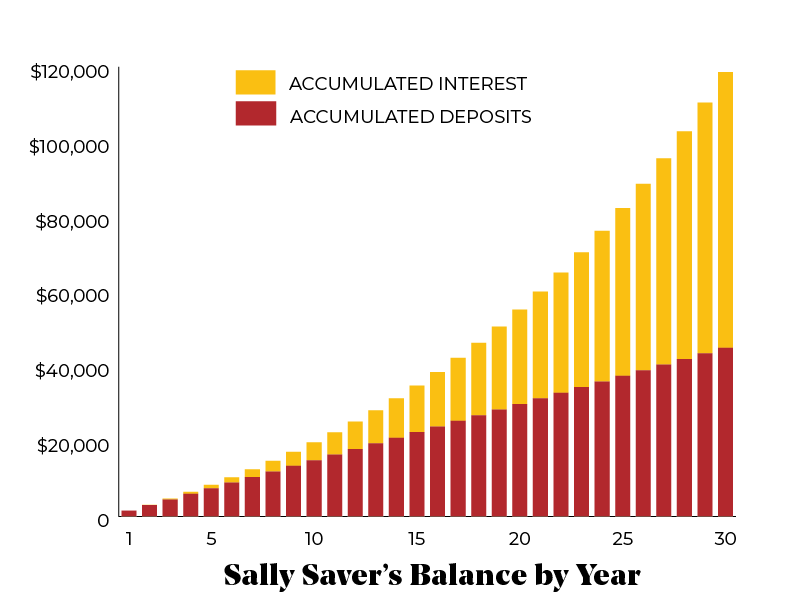

SituationAfter finishing her degree, Sally landed her first job in her field at the age of 25. She had clear financial goals, including starting her retirement savings early, saving for a home, paying off her student debt and purchasing a car. Sally was committed to achieving these goals and starting her savings journey as soon as possible.Sally’s financial journey Sally received advice from her father to seek assistance from an SCU deposit expert to discuss her dreams and goals. They suggested opening an RRSP account to start with and also recommended that Sally explore other savings options for her short-term goals and a future downpayment for a house. Together with SCU’s deposit expert, Sally developed a savings plan that would help her achieve her financial aspirations. Sally was committed to achieving these objectives and starting her savings journey as soon as possible.  Recommendations Sally and her MFRA established an automated bi-weekly transfer of $62.50 from her chequing account to her RRSP. Using the principle of “set it and forget it”, this meant Sally could contribute $1,500 annually without having to think about it. Sally felt confident that she could accomplish her goals, start her savings journey, make monthly car payments, and maintain her contributions at a little under $4.40 a day In addition to opening an RRSP account, her deposit specialist suggested Sally consider a mix of savings products that aligned with both her short-term and long-term goals. Including:

Want to get off the mark fast? Contact our financial fitness deposit experts at 1.800.728.6440 and start your retirement savings journey! Book an appointment today! |

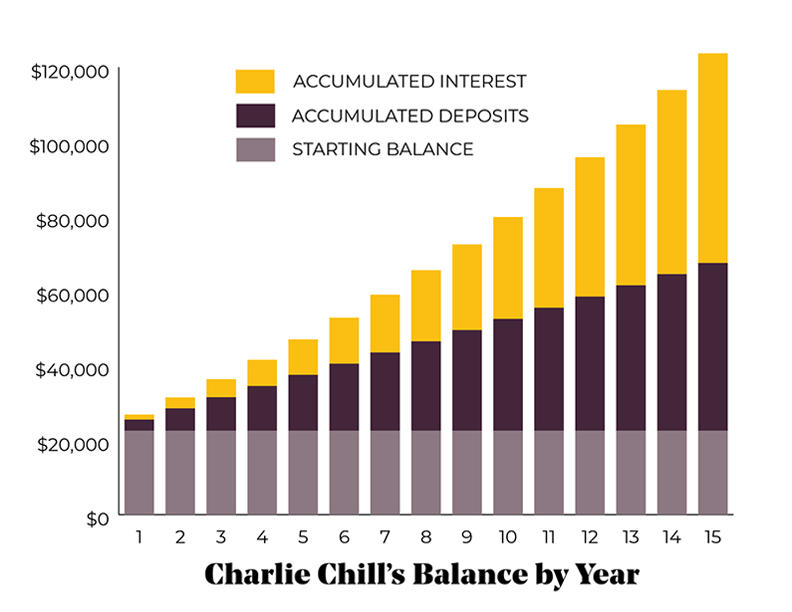

SituationCharlie has been working consistently since his graduation; however, because he has focused his time and resources to entrepreneurial interests, he hasn’t started saving for his retirement yet. Although he has some assets, including a home, some non-registered investments, and a high-interest savings account, he realizes that he needs to start getting serious about his RRSP contributions as he is already 40 years old. Since Charlie is earning more at this stage of his life, it is highly beneficial for him to make RRSP contributions. This is because he will receive a significant tax return due to his higher tax bracket.Charlie’s financial journey Charlie had a meeting with a member of SCU's wealth management team to discuss his financial goals. During the meeting, they talked about Charlie's business and financial objectives, which included starting to save for his retirement and catching up on his RRSP contributions. Charlie provided an account of his accumulated savings and investments outside of RRSPs to his advisor. The purpose was to determine the best options for Charlie to achieve his goals.  Recommendations Charlie has opened an RRSP account and with his wealth advisor has set up automated monthly transfers from his HISA account. Charlie will be contributing $250 each month, which will add up to $3,000 each year. Since Charlie already has some money in his savings account, and the available contribution room in his RRSP, his advisor suggests he could benefit from using these funds towards a lump sum contribution. If he can top up his contribution with funds from his savings account in the first year ($22,500), he’ll be off to a good start on his road to retirement. His wealth advisor also suggested that Charlie could fortify his retirement savings by leveraging his higher income and taking these steps:

Learn more about RRSPs and your options Want to get your retirement plan in shape? Contact our financial fitness deposit experts at 1.800.728.6440 and kick start your road to retirement ! Book an appointment today! |